Social Entrepreneurship: Ten Questions with David Bornstein

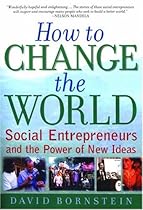

David Bornstein is the author of of How to Change the World: Social Entrepreneurs and the Power of New Ideas. Guy Kawasaki posts ten questions he asked David.

Here's one of Guy's questions:

Question: How can social entrepreneurs attract talent when there aren’t high salaries and options?

Answer: By offering people employment opportunities that align with their talents, interests, and values. By inspiring them with a vision of changing the world, of being part of something bigger than themselves. We have to think about an assumption behind this question—namely the notion that people seek to maximize how much money they make. Certainly, we all care about making money. But choices that people make every day—becoming teachers, having children, giving money to charity—indicate that we are complex creatures motivated by many different things.

We are also at an interesting point in America’s history. With all our wealth and freedom of choice, we seem to be obsessed with finding happiness. Everyday it seems another book is published focusing on how we can make ourselves happy. Most Americans today are phenomenally wealthy compared to their grandparents, yet many studies show we are no happier, and we actually may be less so. At the very top of the list of things that make people feel happy and fulfilled are doing work that you find challenging and deeply meaningful with colleagues whom you respect and care for. Social entrepreneurship offers this.

Great questions, better answers.

read more | digg story

---------------------

Interested in learning more about social enterprise? Take a browse through the Vancouver Social Enterprise Book Store (Vancouver | United Kingdom | United States) and see what other social entrepreneurs recommend reading.

Tags for information about: for:vsef, Social Enterprise, Nonprofit

Tags for information about: for:vsef, Social Enterprise, Nonprofit

--------------------

Labels: Book Store, Opinion, Questions, Social Enterprise, Yunus

Continue reading this item ...